Table of Contents Show

It’s been a roller coaster for anyone buying or shopping for recreational vehicles the last few years. As if supply shortages and a surge in demand weren’t enough, high interest rates also snuck into the picture.

While some excited consumers may gloss over the percentage when signing on the dotted line, this can be a significant mistake. The interest rate on your loan is a critical piece to consider.

Today, we’re examining how interest rates impact RV sales in 2024. Is it a good time to buy?

Let’s look and see!

What Are Interest Rates?

Interest rates are how financial institutions make a return on their investment when lending money. Whether for a home loan, auto loan, or credit card, consumers must pay back what they borrowed and a certain amount of interest. It may be easiest to consider it as a recurring fee for borrowing someone else’s money.

This rate is typically a specific percentage of the amount borrowed or financed.

Depending on the type of loan, you’ll often see fixed and variable interest rates. A fixed-rate remains the same throughout the life of the loan, but a variable rate can change over time.

How Do Interest Rates Impact Consumer Purchases?

Interest rates are constantly adjusting in response to market trends and the economy. They play a massive role for consumers, especially for larger purchases.

Lower interest rates make it more affordable to take out loans. During these times, we’ll often see increased purchases of homes, cars, and other big-ticket items.

On the other hand, when interest rates increase, borrowing money becomes more costly. During these times, consumers are often very cautious about new loans, and financial institutions tighten approval qualifications.

This often results in reduced spending and an overall slower market.

How Interest Rates Are Impacting RV Sales in 2024

As we mentioned, interest rates have a significant influence on consumer behavior. So, how are they impacting RV sales in 2024? Let’s take a look.

Harder to Get Approved

Interest rates have been steadily climbing over the last few years. The Federal Reserve made multiple increases in 2023 in hopes of slowing inflation. While their efforts appear successful, we’ve yet to see a reduction.

As a result, banks in 2024 continue to be rather strict regarding approvals. Since most financial institutions see RVs as luxury purchases, getting approved has typically always been more difficult.

However, it has been even more challenging for consumers in the past few years.

Start getting your finances in order if you plan to buy an RV or any other major purchase in 2024. Use online resources like Credit Karma to check your credit score and history.

It’s also essential to have a steady employment history. Clean up any issues that may be red flags to lenders. You want to be as appealing as possible to lenders to help get approved.

Pro Tip: Check out Where to Find RV Loan Rates and Reliable Financing before committing to a dealership.

More Expensive Monthly Payments

Another way interest rates impact RV sales in 2024 is through the monthly payments. Even a slight percentage increase will cause the monthly payment to increase.

As a result, some consumers can no longer afford the monthly payments when financing.

This can make it extremely challenging for those trying to squeeze a purchase into their budget. Consumers may have to choose a less expensive camper or save up for a larger down payment.

Longer Terms

Some consumers opt to extend their loan terms to offset increased monthly payments.

Instead of five or 10-year terms, many care opt for 15 to 20-year terms. Doing so can drastically reduce the monthly payment and make ownership possible.

However, you must remember that RVs, like most vehicles, depreciate very quickly. In a few years, most recreational vehicles are worth only a fraction of their original value.

Extending the terms of your loan can allow you to pay less each month, but you’ll quickly find yourself owing more than your rig is worth. This can become a substantial problem if you try to sell it.

Pro Tip: Have you ever wondered Is Zero-Down RV Financing Possible? Click the link to find out!

Less Movement at Dealerships

If you visit an RV dealership lately, you likely have plenty of options to consider. The increased interest rates have caused consumers to put off major purchases, especially RVs.

As a result, dealerships aren’t moving inventory nearly as quickly.

This is a much different experience than consumers experienced over the last few years. Dealerships sat with nearly empty lots, and those shopping for a camper had to search high and low to find them.

However, a decrease in demand and the higher interest rates are causing dealerships to have plenty of inventory.

Price Declines

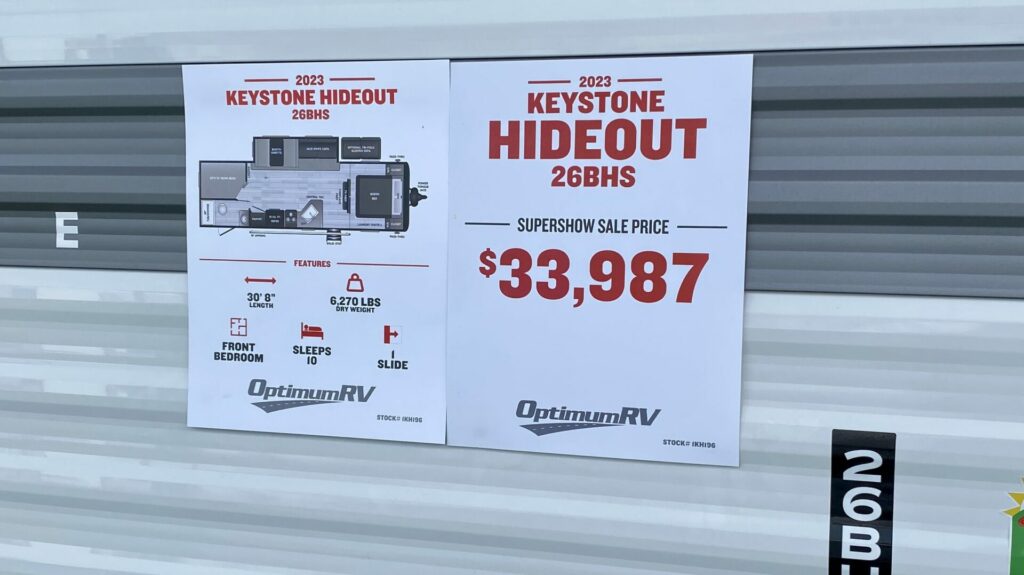

While higher interest rates can be frustrating for consumers, there is one way they’re helping. We’re seeing price drops and adjustments at dealerships across the country.

Unfortunately, it’ll likely be some time before they return to normal before the chaos of 2020.

As a result, feel free to try to negotiate at the dealership. You can save yourself 10 to 25% off the MSRP of a camper. Every dollar you can avoid financing is more money you keep in your pocket.

Pro Tip: If you’re ready to pull the trigger on an RV, be sure to read 10 Key Tips For Negotiating The Best RV Price first!

Will Interest Rates Decline in 2024?

The Federal Reserve has mentioned that it expects to reduce interest rates in 2024. However, when or by how much is anyone’s guess.

We’re hopeful that we’ll see some noteworthy changes and that those consumers on the fence will be able to pull the trigger. Do you plan to buy an RV in 2024?