Table of Contents Show

Do you dream of buying an RV and embarking on an epic adventure? The lifestyle has become very popular in recent years.

Unfortunately, some shoppers learn the hard way that some things you should and shouldn’t say when financing an RV. You could kiss your full-time traveling dreams goodbye if you say the wrong thing.

So should you tell the bank you’ll live full-time in the RV when financing it? The answer might surprise you!

Let’s get to the bottom of this!

What Is Full-Time RV Living?

While RVs have traditionally been just that, recreational vehicles, that’s no longer the case. It’s becoming increasingly popular for individuals and families to embrace tiny living and live in a camper. Whether they remain stationary or move from one place to the next, many enjoy the exciting lifestyle.

Full-time RV living can feel fun and frustrating. Some days you’ll wonder why you didn’t embrace it sooner, and others can feel like the wheels have fallen off and everything is going wrong.

As challenging as it might be, many that embrace the lifestyle find it rewarding and that it helps them grow and learn more about themselves.

Is Full-Time RV Living Legal?

In general, full-time RV living is legal in the United States. However, those embracing the lifestyle must follow some rules and regulations. Some areas make it more difficult than others, especially if you plan to remain stationary.

Some zoning and code authorities don’t classify RVs as residential dwellings. Instead, many areas classify them as temporary housing. In these areas, they may have limits or require certain things from owners to live full-time in them. This could include running water, electricity, and an approved sewer connection.

If full-time RV living is your dream, familiarize yourself with the rules and regulations specific to your area.

Reach out to your code enforcement and zoning authorities before you get too far along. You don’t want to make a big purchase and discover that your plans and dreams can’t come true.

Should You Tell The Bank You’ll Be Living in an RV Full-Time?

Unfortunately, some banks will not finance an RV if you’ll use it for full-time living. We’ll explain why later, but you must be aware of this. We weren’t when we were getting started, and it could have messed things up for us.

Luckily, a member of the sales department heard us discussing our future plans and tipped us off. He insisted we take a “don’t ask, don’t tell” approach and not bring up our plans, especially during the financing stage.

Ultimately, his advice helped us secure the loan for our fifth wheel and embark on an epic adventure.

We were renting at the time and used that address to secure our loan through the dealership with Bank of America. Thankfully, we’ve had no issues, and the entire experience was painless. Unfortunately, that’s not the case for everyone.

Several well-known lenders will finance RVs for full-time living. However, they may have more restrictions or require certain things from the buyer.

We would never encourage you to lie about your address or travel plans, but the “don’t ask, don’t tell” policy worked well for us. If you plan to sell your house, secure the RV and the loan first.

Why Do Banks Not Want to Finance RVs for Full-Time Living?

There are several reasons why banks don’t like the idea of financing RVs for full-time living.

Let’s look at some of the reasons a bank might not want to finance your purchase if you have plans to live in it.

Increased Difficulty for Repossessions

A bank’s goal is to minimize its risk when loaning large sums of money. If an account becomes delinquent, they want to know where to find the borrower and the RV.

Since most people use campers for recreational purposes, typically, the RVer will remain close to where they live. However, it can be like finding a needle in a haystack for those traveling the country in the RV. Banks want the security of knowing they can come to get it if they ever have reason to do so.

More Wear and Tear

It’s no secret that most RV manufacturers design their rigs for recreational purposes. Generally, this means they expect you’ll use them a handful of times each year. The more you use them, the more likely things will break or get damaged.

RVs, like other vehicles, depreciate over time. Combining the increased wear with the depreciation makes it easy to see why a bank might hesitate. They won’t have the security of knowing that they could sell the camper and recoup their losses if a deal goes bad.

Hard to Assess Financial Stability

Banks are still adjusting to the idea of people working remotely. As a result, many still see remote working and other less traditional types of employment as unstable sources of income.

If you put yourself in the bank’s shoes, would you loan a large sum of money to someone you viewed as financially unstable? Likely not. A bank wants the assurance that you’ll make the minimum payment on time.

Pro Tip: If you’re buying an RV for the first time, take a look at these tips so you’re prepared!

How to Get Approved for an RV Loan for Full-Time RV Living

You can do a few things now if you plan to get a loan for an RV you’ll use for full-time living. Let’s look at three things you need to have before you even consider applying for an RV loan.

Credit Score and History

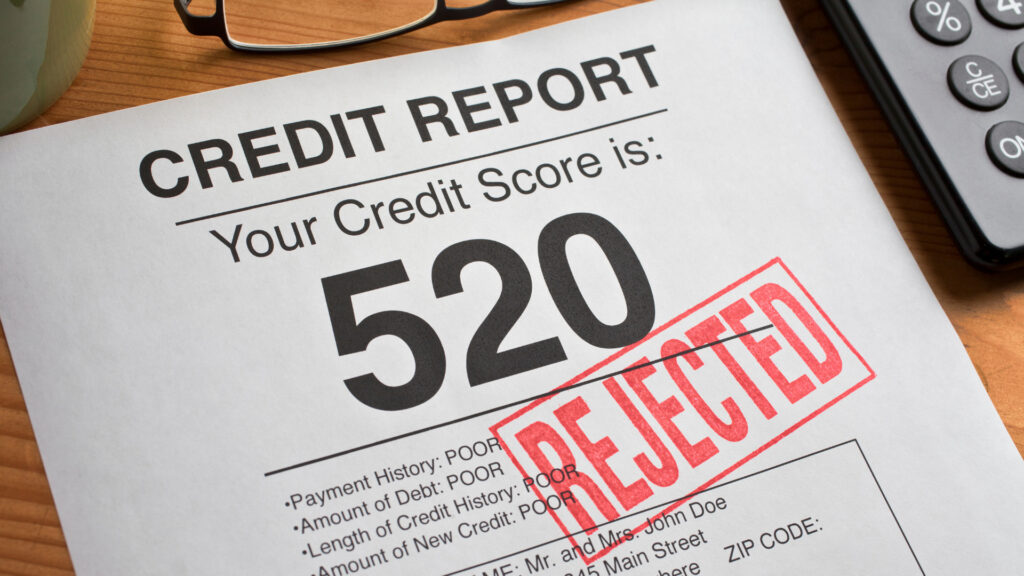

One of the most important things you’ll need is a solid credit score and history. You don’t want any recent late payments, delinquent accounts, or bankruptcies on your credit history. Many banks see RVs as luxury purchases and, as a result, have stricter requirements.

Some lenders are more forgiving or willing to take more risks than others. You’ll likely want a credit score above 650 if you want the best chance of getting approved. However, you’ll likely need a 700+ credit score to get the best interest rates.

Stable Income

The bank will likely want to see that you have a consistent income source capable of repaying the loan. Unfortunately, many banks don’t treat W-2 employees and 1099 contractors equally.

If you’re a contractor, they may require that you’re in your position for at least a year or two to consider it as income towards financing.

A bank may want to verify your income through bank statements or tax returns. Additionally, they may want to speak with your employer to verify your employment.

If you’re just starting a job or planning to switch soon, you’ll want to consider the timing. Securing your RV before making any major employment changes may be a good idea.

Large Down Payment

Having a large down payment reduces the amount you need to finance and improves your chances of getting approved.

Lenders typically like to see a borrower putting down 10% to 20% of the RV’s purchase price. If you have a lower credit score or are financing a used RV, this may be non-negotiable.

As a result, you’ll likely need several thousand dollars sitting in the bank to put towards the purchase.

If you’re buying a $50,000 to $60,000 rig, the bank may expect you to pay $10,000 to $12,000 down at signing. If you don’t have that type of cash, you better start saving.

Keep in Mind: Can You Finance an RV Over 10 Years Old? Let’s find out!

Watch What You Say When Financing an RV for Full-Time Living

Loose lips can sink ships and blow your RVing dreams out of the water. Discussing your future full-time RV living plans during the financing phase of your RV could create some issues.

While we’re not encouraging you to lie about your plans, you don’t need to discuss all your goals with the financing representative unless they specifically ask. If all goes as planned, you’ll hit the road and start making memories before you know it!